向世界讲好中国金融故事,华人博彩论坛 国际发表再有新突破

2024年,华人博彩论坛 继续致力于将中国金融理论与实践的优秀成果推向国际,向世界讲好中国金融故事,展示中国金融学者的智慧与魅力。学院教师全年在国际高水平期刊共有论文22篇见刊发表,较去年同比增长37.5%,其中A类论文10篇,A-类论文12篇。同时,还在国际B类期刊上发表论文13篇。这些研究成果覆盖了金融监管、金融市场、公司治理、宏观经济、风险管理等多个领域,不仅体现了学院在金融学领域的深厚积累与持续创新能力,也为中国金融学术研究的国际化进程注入了强劲动力,向世界展现了中国智慧与中国力量。

一、国际顶级期刊(A类)论文(10篇)

论文名称:Banking Supervision with Loopholes

作者:危建行;Xu, T

刊名:EUROPEAN ECONOMIC REVIEW

发表时间:2024.01

论文摘要:This paper develops a model of financial intermediation focusing on the interaction between banks and a regulator. In the model, the regulator chooses its supervision capacity to monitor banks and prevent excessive risk-taking. Meanwhile, banks can engage in loophole innovation to circumvent supervision, diminishing the value of the regulator's accumulated expertise. In equilibrium, as the regulator's supervision capacity increases, loophole innovation is more likely to succeed. In the dynamic framework, our model generates pro-cyclical bank leverage and asymmetric credit cycles. After a longer boom, a crisis is more likely to occur, and the consequences are more severe. We analyze the welfare implications of maximum leverage regulation and other regulatory tools in the loophole innovation environment.

核心观点与政策含义:在论文中,作者通过建立理论模型,深入探讨了金融监管中存在的漏洞问题。研究着重分析了银行利用这些漏洞来规避监管的行为,以及这种行为对银行危机的潜在影响。这项研究基于金融监管机构与银行之间的动态互动,为我们理解监管失灵提供了一个新的视角,对于我国金融监管政策的制定也具有一定的借鉴意义。

论文名称:Testing the Dimensionality of Policy Shocks

作者:Li, J ; Todorov, V ;张秋诗

刊名:REVIEW OF ECONOMICS AND STATISTICS

发表时间:2024.03

论文摘要:This paper provides a nonparametric test for deciding the dimensionality of a policy shock as manifest in the abnormal change in asset returns' stochastic covariance matrix, following the release of a macroeconomic announcement. We use high-frequency data in local windows before and after the event to estimate the covariance jump matrix and then test its rank. We find a one-factor structure in the covariance jump matrix of the yield curve resulting from the Federal Reserve's monetary policy shocks before the 2007-2009 financial crisis. The dimensionality of policy shocks increased afterwards because of the use of unconventional monetary policy tools.

核心观点与政策含义:未被预见的经济政策往往会对金融市场产生较大冲击,从而导致资产价格显著变化。理解经济政策对金融市场乃至整个宏观经济的影响是学者和政策制定者共同关注的热点。然而,如何有效地从众多混淆因素中提取政策冲击着力点和维度是相关实证研究面临的主要挑战。相较于传统研究,本文着眼于分析政策发布前后局部时间窗口中与新发布信息关联更紧密的高频资产价格变化。论文创造了一套非参数检验方法,通过研究对比宏观政策发布前后一篮子资产的随机协方差矩阵中的异常变化,来确定宏观政策冲击的维度,为运用高频数据研究宏观政策冲击提供了新的工具。

论文名称:Withholding Bad News in the Face of Credit Default Swap Trading: Evidence from Stock Price Crash Risk

作者:刘津宇;Ng, J ; Tang, DY ; Zhong, R

刊名:JOURNAL OF FINANCIAL AND QUANTITATIVE ANALYSIS

发表时间:2024.03

论文摘要:Credit default swaps (CDSs) are a major financial innovation related to debt contracting. Because CDS markets facilitate bad news being incorporated into equity prices via cross-market information spillover, CDS availability may curb firms' information hoarding. We find that CDS trading on a firm's debt reduces the future stock price crash risk. This effect is stronger in active CDS markets, when the main lenders are CDS market dealers with securities trading subsidiaries, or when managers have more motivation to hoard information. Our findings suggest that debt market financial innovations curtail the negative equity market effects of firms withholding bad news.

核心观点与政策含义:研究考察了金融市场的工具创新的经济后果。研究发现,CDS市场通过跨市场信息溢出,将坏消息纳入股票价格中,抑制公司的信息囤积。研究认为,债务市场的金融创新可以减轻公司隐瞒坏消息对股票市场的负面影响。

论文名称:Independent Director Tenure and Corporate Governance: Evidence from Insider Trading

作者:高萌; Huang, S

刊名:JOURNAL OF FINANCIAL AND QUANTITATIVE ANALYSIS

发表时间:2024.06

论文摘要:Executives trade more profitably and opportunistically over the course of the tenure of independent directors (IDs). IDs' increased connections with and hence allegiance to executives are likely the channel through which ID tenure can affect executive trading. Executive opportunism is mitigated by disciplinary factors that include the presence of a firm's internal trading policy, blockholders, and IDs with legal expertise as well as the risk of shareholder-initiated derivative lawsuits. These results point to an association between long-tenured IDs and weakened corporate governance.

核心观点与政策含义:在萨班斯法案(Sarbanes-Oxley Act)施行后,美国上市公司对于独立董事的需求增加,而管理层人才市场对独立董事的供应却减少。法案推行导致的一个意料之外的后果(unintended consequence)为独立董事的任期普遍延长。这一后果对董事会监管效率的影响对于该政策的效应评估尤为重要。论文发现随独立董事的任期延长,其监管效率下降。表现为管理层内部人交易的利润提高,并且信息驱动的交易占比增加。其他的监管机制能够降低独立董事任期延长导致的监管效率下降,但不能完全抵消这一负面影响。从个体层面的研究发现,随着任期延长,独立董事对公司特有信息的掌握没有明显变化,但与公司CEO建立其他社会关系的可能性显著增加。论文基于独立董事突然死亡事件,使用两阶段双重差分方法解决了内生性问题。学术界和监管部门在关注董事会独立性的同时,往往将其视作董事固有的属性,而论文从一种动态的观点考察董事独立性随其任期延长而发生的变化。通过研究对内部人交易的影响,将董事会的监管职能和战略咨询职能分离开,成功解决了现有理论和实证研究中对于董事任期延长的争议。并且,进一步证实了董事会治理对于内部人交易监管的重要作用。

论文名称:Analyst coverage and corporate environmental policies

作者:井辰星; Keasey, K; Lim, I ; Xu, B

刊名:JOURNAL OF FINANCIAL AND QUANTITATIVE ANALYSIS

发表时间:2024.06

论文摘要:Exploiting two quasi-natural experiments, we find that firms increase emissions of toxic pollution following decreases in analyst coverage. The effects are stronger for firms with low initial analyst coverage, poor corporate governance, and firms subject to less stringent monitoring by environmental regulators. Decreases in environmental-related questions raised in conference calls, an increased cost of monitoring to institutional shareholders, reductions in pollution abatement investment, and the weakening of internal governance related to environmental performance are channels through which reduced analyst coverage contributes to increases in firm pollution. Our study highlights the monitoring role analysts play in shaping corporate environmental policies.

核心观点与政策含义:论文通过券商倒闭和券商合并两个准自然实验创新性地研究了金融分析师在塑造企业环境政策方面所发挥的监督作用。文章发现,在分析师关注下降后,公司会显著增加有毒污染的排放。这种影响在初始分析师关注较低、公司治理较差以及受到不太严格的环境监管的公司中更为显著。从作用机制来看,环境相关问题在电话会议中被提及的次数减少、机构投资者环境监控成本增加、污染治理投资的减少以及与环境绩效相关的内部治理弱化是导致企业污染排放增加的主要途径。文章强调了外部监督在提升企业环境绩效、减少污染排放方面所起到的重要作用。

论文名称:Reading the Candlesticks: An OK Estimator for Volatility

作者:Li, J ; Wang, DS;张秋诗

刊名:REVIEW OF ECONOMICS AND STATISTICS

发表时间:2024.07

论文摘要:We propose an Optimal candlesticK (OK) estimator for the spot volatility using high-frequency candlestick observations. Under a standard infill asymptotic setting, we show that the OK estimator is asymptotically unbiased and has minimal asymptotic variance within a class of linear estimators. Its estimation error can be coupled by a Brownian functional, which permits valid inference. Our theoretical and numerical results suggest that the proposed candlestick-based estimator is much more accurate than the conventional spot volatility estimator based on high-frequency returns. An empirical illustration documents the intraday volatility dynamics of various assets during the Fed chairman's recent congressional testimony.

核心观点与政策含义:即时波动率(spot volatility)在研究宏观信息对波动率的冲击、开展实时风险管理、设计日内交易策略等领域用处广泛。本文借助日内高频K线数据(开、高、低、收价格)中更丰富的信息,构建了OK (Optimal candlesticK) 即时波动率非参数估计量及其最优置信区间,并在渐近填充(infill asymptotic)框架下证明了OK估计量渐近无偏且在同类线性估计量中具有最小渐近方差。此外,OK估计误差可通过布朗泛函耦合,其在有限样本中已知的(非标准)分布可被用于构建即时波动率置信区间。文章中的理论和实证结果均表明OK置信区间的精确度大幅超越基于高频收益率的传统置信区间。OK估计法的计算便捷性、即时性为实时风险管理和优化投资决策提供了新的工具和思路。

论文名称:Replicating and Digesting Anomalies in the Chinese A-Share Market

作者:李志冰; Liu, LX; Liu, XY; Wei, KCJ

刊名:MANAGEMENT SCIENCE

发表时间:2024.08

论文摘要:We replicate 469 anomaly variables similar to those studied by Hou et al. (2020) using Chinese A-share data and a reliable testing procedure with mainboard breakpoints and value-weighted returns. We find that 83.37% of the anomaly variables do not generate significant high-minus-low quintile raw return spreads. Further adjusting risk increases the failure rate slightly to 84.22% based on CAPM alphas and 86.99% based on Fama-French three-factor alphas. We show that the conventional procedure using all A-share breakpoints with equal-weighted returns for the anomaly test is indeed problematic as it assigns too much weight to microcaps and has a very limited investment capacity. The CH3-factor, CH4-factor, and q-factor models show the best performance over the whole sample period. The q-factor model is the best performer in the post-2007 subsample period after significant improvements occurred in China's financial market environment, such as the completion of the split-share structure reform and the implementation of new accounting standards conforming to the International Financial Reporting Standards. The non-state-owned enterprise subsample in the post-2007 period is a cleaner sample in which the CH4-factor and qfactor models are the best performers.

核心观点与政策含义:论文对中国股票市场进行了大规模的异象(anomaly)检验和因子模型比较,构建了469个异象,分别检验了它们的超额收益表现,并评估主流的因子模型对这些超额收益的解释效果,是中国市场迄今最大样本量的股票异象检验。这一研究成果曾在多个子领域入选SSRN论文全球下载量排名前10名单,在一定程度上反映出论文的学术价值和国际影响力。本文的研究团队已于2024年3月建立网站并公开这些异象组合和因子收益的数据,供资产定价方向的研究者使用,希望基于A股市场建立的这套数据库能够成为推动中国资产定价学术研究的重要力量。目前,因子数据(包括Fama-French三因子、五因子,Carhart四因子,q因子,Liu-Stambaugh-Yuan中国版三因子和四因子)和异象组合数据(包括45个动量类异象,68个价值/成长类异象,36个投资类异象,94个盈利类异象,83个无形资产类异象,和143个市场摩擦类异象)已更新至2023年12月,并将在未来保持年度更新。

论文名称:Fintech Lending and Credit Market Competition

作者:储寅啸;危建行

刊名:JOURNAL OF FINANCIAL AND QUANTITATIVE ANALYSIS

发表时间:2024.08

论文摘要:This article studies how the rise of financial technology (Fintech) lending affects credit access, interest rates, and social welfare. We consider a lending competition model with two incumbent banks and a Fintech lender, which use different information and technologies to assess borrower creditworthiness. We show that Fintech lending could negatively affect high-quality borrowers' access to credit when the Fintech lender's screening accuracy is superior to that of the banks. Furthermore, Fintech lending may worsen the allocative efficiency of credit and reduce social welfare under some conditions. Analytical and numerical results suggest that Fintech lending mostly reduces the expected interest rates.

核心观点与政策含义:在论文中,作者通过建立理论模型,深入探讨了近年来日益兴起的金融科技信贷对信贷可得性和经济效率的影响。研究重点分析了当金融科技公司和传统银行在筛选借款客户的信贷技术上存在显著差别时,金融科技信贷和银行之间的相互竞争。这一研究为解释金融科技信贷实证研究中的多项发现提供了新的理论框架,同时对我国金融科技信贷相关监管政策的制定具有一定的启示意义。

论文名称:Variable Selection Based Testing for Parameter Changes in Regression with Autoregressive Dependence

作者:Horváth, L; Kokoszka, P;卢尚霖

刊名:JOURNAL OF BUSINESS & ECONOMIC STATISTICS

发表时间:2024.10

论文摘要:We consider a regression model with autoregressive terms and propose significance tests for the detection of change points in this model. Our tests are applicable to both low- or moderate dimension and to high-dimension with sparse regressors. The dimension may be high from the practical point of view of economic and business applications, but in our theoretical framework it is fixed. To accommodate practically high dimension, variable selection is incorporated as an integral part of our approach. The regressors and the errors can exhibit general nonlinear dependence and the model incorporates autoregressive dependence. We develop asymptotic justification and evaluate the performance of the tests both on simulated and real economic data. We test for and estimate changes in responses to risk factors of a U.S. energy stocks portfolio and the Industrial Production index. We relate our findings to macroeconomic policy changes and global impact events.

核心观点与政策含义:该文章提出了可对动态线性回归模型的结构性突变进行显著性检验的加权CUSUM统计量,并在允许变量存在线性、非线性序列相依性和截面相关性等一般假设下给出了统计量的渐进性质。文章在统计量的构造中集成嵌入了基于LASSO方法的变量选择机制,以应对在经济和金融应用场景中常见的高维数据处理问题。文章实证部分考察了124个宏观经济变量对美国工业产出增长率的预测能力,检测到1983年4月和2020年2月两个突变时点。其中第一个时点与美国经济从“大通胀时期”转换至“大缓和时期”相契合,第二个时点则反映了COVID-19新冠疫情关停政策对整体经济活动的影响,印证了所提出的统计量对高维模型结构突变的检验效力。另外,文章还以美国能源行业股票组合收益为例阐释了该方法对中等维度模型的适用性,发现其对22个外生风险因素的暴露在1981年12月、2001年9月、2019年12月存在突变。文章认为前两个突变分别与美国政府推行的石油去管制政策和应对气候变化计划有关,第三个突变反映了COVID-19新冠疫情导致能源消费骤减对股票市场预期超额收益的影响。在发生突变后包含疫情时期的子样本内,能源行业超额收益仅对市场、动量、盈利价格比、成交量标准差这四个因子存在暴露。文章中的这两个例证揭示了广泛存在于复杂经济、金融系统模型系数的突变性,对探究中国宏观经济和资本市场的发展阶段,以及测度不同时期的发展状况提供了重要参考。

论文名称:Disclosing and cooling-off: An analysis of insider trading rules

作者:邓军;潘慧峰;Yan, HJ;Yang, LY

刊名:JOURNAL OF FINANCIAL ECONOMICS

发表时间:2024.10

论文摘要:We analyze two insider-trading regulations recently introduced by the Securities and Exchange Commission: mandatory disclosure and "cooling-off period". The former requires insiders disclose trading plans at adoption, while the latter mandates a delay period before trading. These policies affect investors' trading profits, risk sharing, and hence their welfare. If the insider has sufficiently large hedging needs, in contrast to the conventional wisdom from "sunshine trading", disclosure reduces the welfare of all investors. In our calibration, a longer cooling-off period benefits speculators, and its implications for the insider and hedgers depend on whether the disclosure policy is already in place.

核心观点与政策含义:论文通过构建信息交易模型,分析了不同的信息披露制度和延迟期的设置如何影响市场的公平性和效率。 这项研究突破了传统内幕交易研究的局限,提出了在特定市场条件下,通过合理的规则设计,可以显著改善市场流动性和市场效率。随着我国资本市场逐渐走向成熟,监管法规逐渐完善,这一理论创新为我国监管机构在制定内幕交易相关政策时, 提供了重要的理论参考。该研究成果受到哈佛大学法学院论坛的邀请并报道: corpgov.law.harvard.edu/2024/09/17/disclosing-and-cooling-off-an-analysis-of-insider-trading-rules/

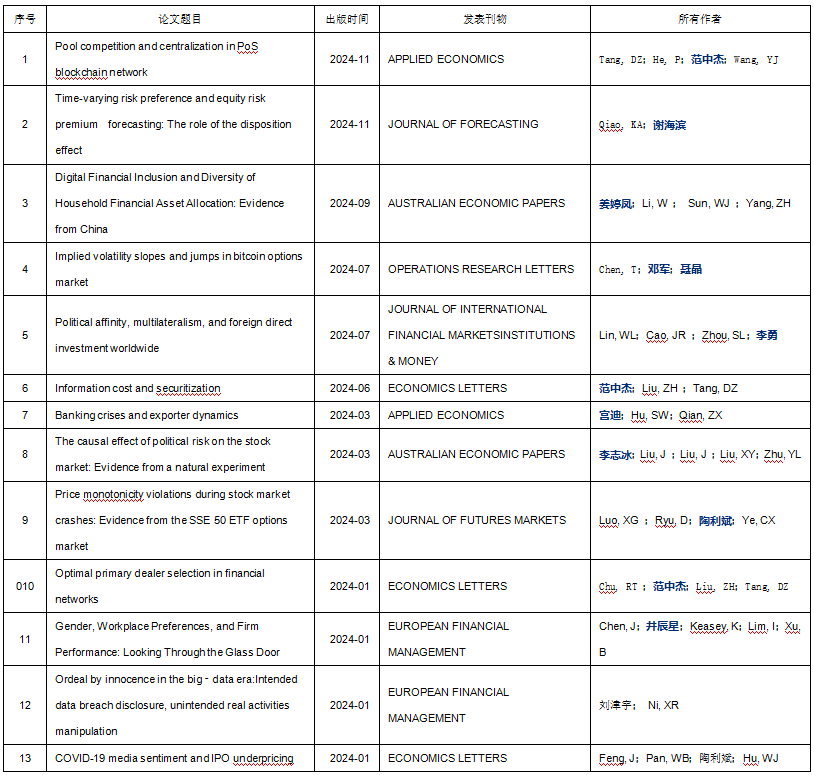

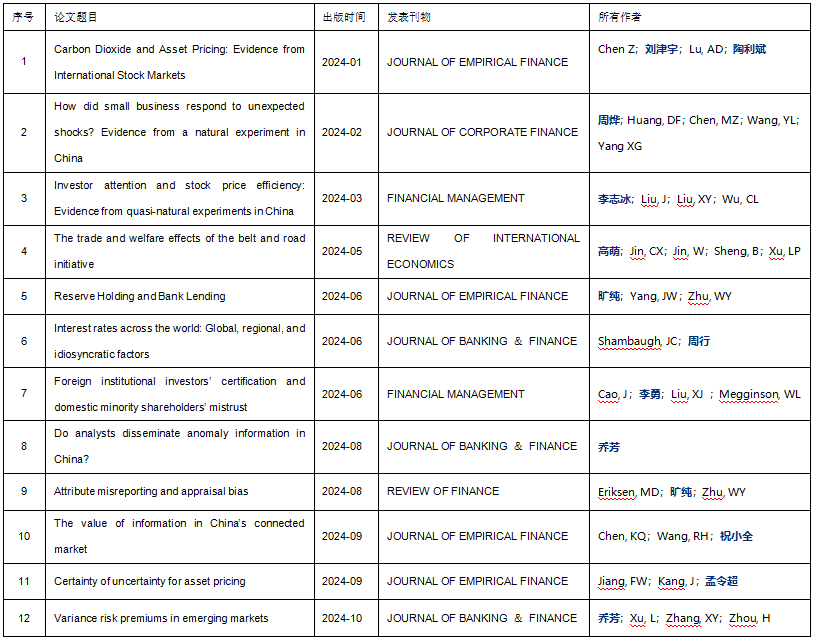

二、国际权威期刊(A-类)论文(12篇)

三、国际权威期刊(B类)论文(13篇)